G.A.M.A.G Group

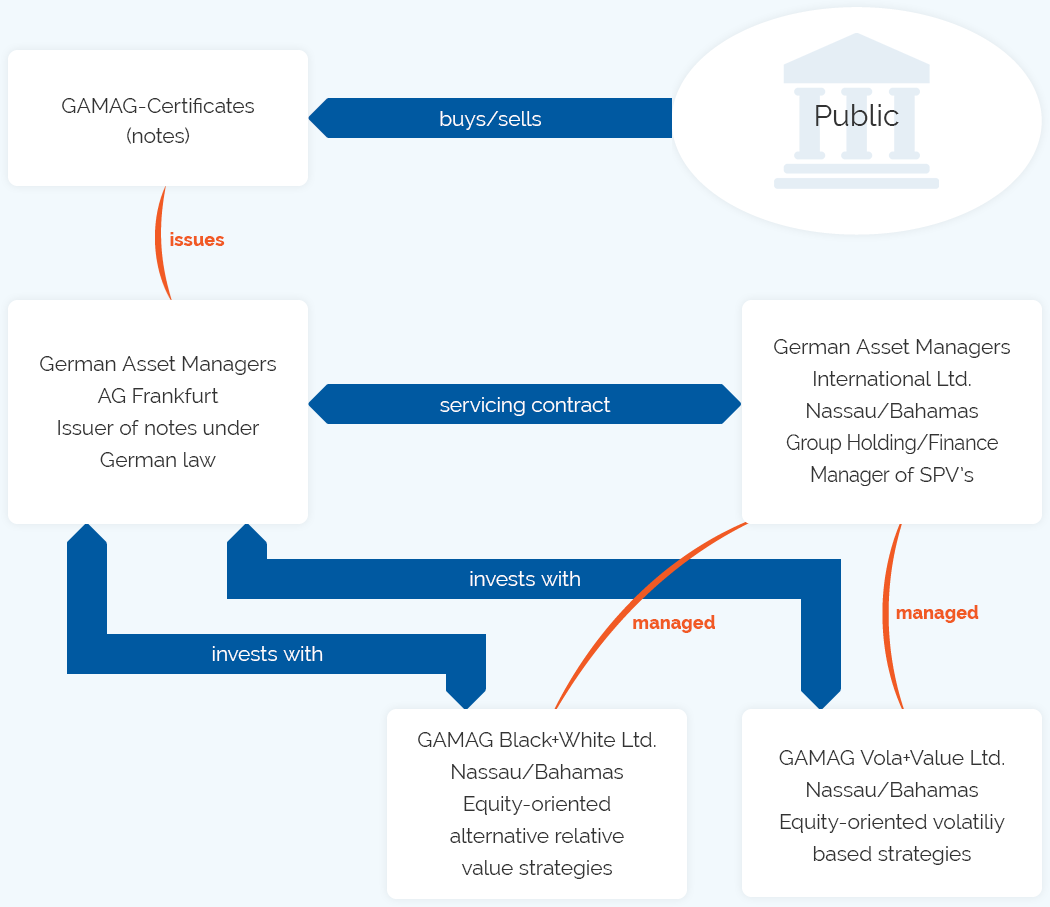

G.A.M.A.G Group is a group of companies investing their proprietary capital internationally using alternative investment strategies. Investors with the G.A.M.A.G companies are buying securities issued by German Asset Managers AG, Frankfurt. This entity invests its monies primarily with GAMAG special purpose vehicles GAMAG Black + White Ltd. and GAMAG Vola + Value Ltd. These companies in turn are investing with hedge funds, are buying stocks, bonds and notes worldwide and use derivatives extensively to hedge or gain from time decay. The investments success is independently monitored and calculated monthly by way of the G.A.M.A.G indices, actively managed performance indices.

Your contacts at GAMAG

Carsten Straush President

Carsten Straush began his career after finishing his exame in banking and finance at Cologne university with the leading German publishing group in the sector developing innovative banking analysis products, organizing and teaching in seminars and workshops and publishing actively about ways to analyse the stock markets. Mid-90s he switched to active portfolio management using derivative products extensively. 1998 he incorporated German Asset Managers AG, which then issued the first index-linked note in Germany and pioneered the concept of actively managed indices. 2001 the second innovation was brought to the market, the Black+White-Certificate, an index-linked note based on a portfolio of hedge funds and alpha-oriented strategies. Thus GAMAG was a first mover in catering hedge funds to the private investor in Germany.

Detlef Weismantel Customer Marketing Director

Detlef Weismantel after finishing his education in banking began his career at one of the leading French global banks. He then switched to a leading German financial intermediary where he promoted new types of financial contracts to institutional clients. Since 2000 in his new role as Customer and Marketing Director he is responsible for the marketing activities of the GAMAG group.

The path of money